Saving and optimizing assets choosing the right investment option for family assets contributes to their preservation and growth. Trusts, foundations and companies in Switzerland and abroad are a suitable means of achieving this goal. Lucrum Capital AG advises its clients on the selection of a suitable investment strategy and its implementation, and regularly monitors and reviews the development of the assets. If the general conditions change, the structure of the asset management is adjusted in time.

Trust-structures

Internationally oriented families whose residential and real estate holdings extend across several national borders, take advantage of Trust structures and foundations. In this way, they can protect their asset and benefit from advantageous tax situations.

Trust structures and foundations represent a legitimate and legal instrument in the financial world to achieve the objectives already outlined.

That is why Lucrum Capital AG advises it’s clients comprehensively, starting with the definition of goals and the filtering out of the client’s needs to the creation of an individual, optimal structure together with the client. Where should it be located, who are the organs, how is the organization regulated and where should the trust, foundation and/or companies carry out their business activities? The choice of the location is significant due to legal and tax circumstances and these decisively shape the framework conditions. Furthermore, it is important to decide which assets are to be implemented and managed in which structure.

Opening of a company for professional purposes

We also make the important preliminary clarifications for you, obtain offers from banks and trust companies and advise you on the selection of suitable companies.

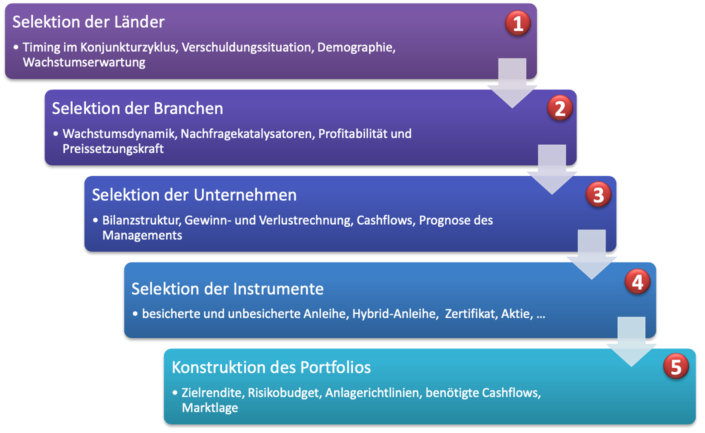

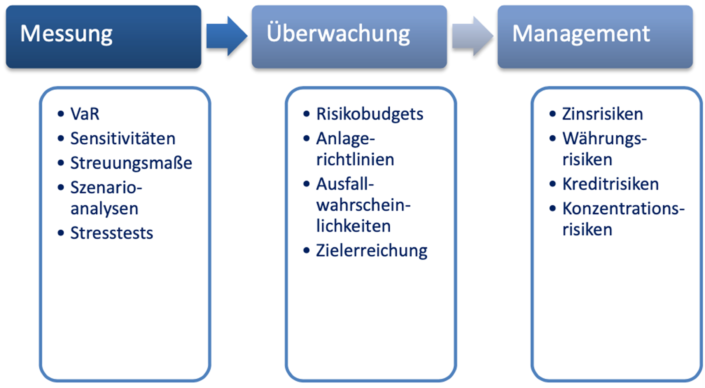

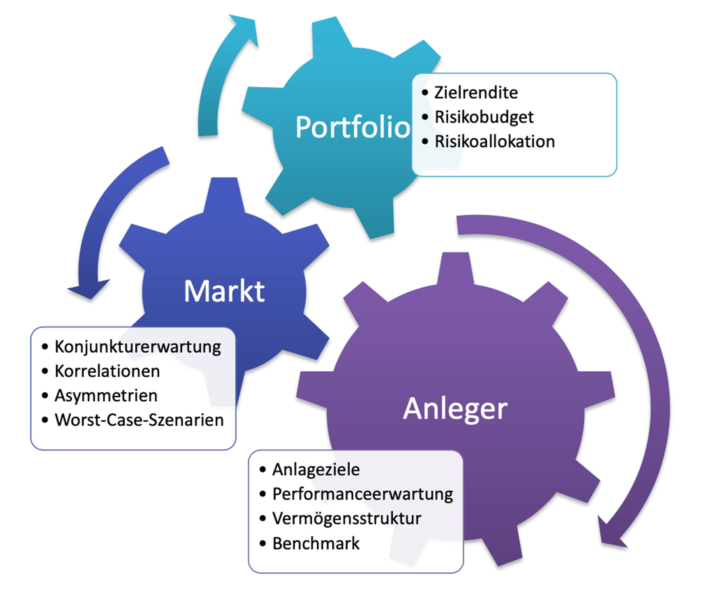

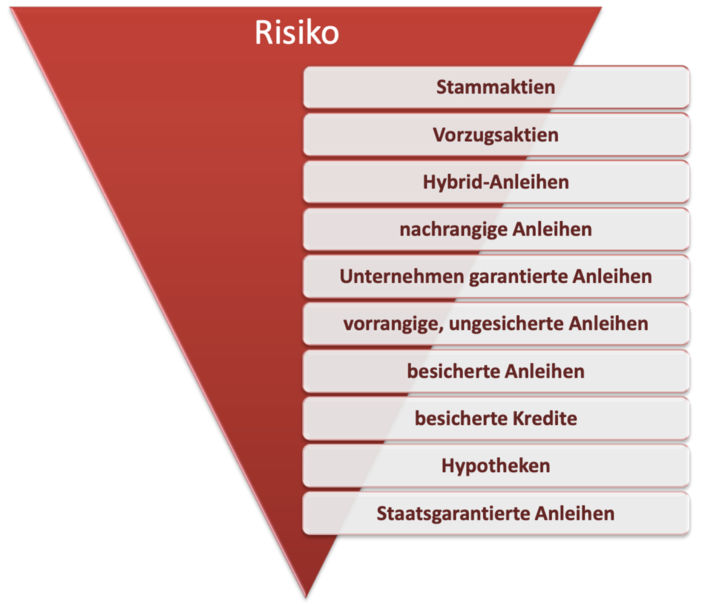

Asset allocation:

Optimizing asset allocation to attractive asset classes.

The determination of the best possible strategic asset allocation forms the basis and depends on the client, his local asset and his individual visions and goals. The basic prerequisite for a sustainable positive development of the invested assets is the constant consideration of the general conditions and liquidity planning.